Green Energy

Jobs, growth and energy independence start with green power

February 19, 2026

July 11, 2025

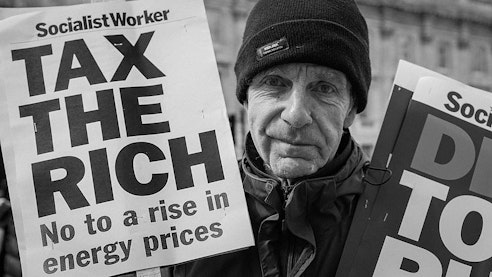

Our tax system currently favours capital over labour: a nurse or a teacher pays a higher effective rate on their earnings than a hedge-fund manager does on assets that simply sit there and grow. Meanwhile, public services buckle under strain and too many families struggle to put food on the table. That has to change and the starting point is a properly designed wealth tax.

A wealth tax is an annual levy on an individual’s net assets once they exceed a government-set threshold. It covers everything from property and investments to savings and other tangible assets, minus any debts or liabilities. In the UK, over thirty MPs and numerous organisations have called for a 2 percent levy on anyone with assets over £10 million, a proposal laid out in detail by Tax Justice UK. It would affect fewer than 20,000 people yet raise around £24 billion every year; revenue that could be redirected into our NHS, social care, and the green transition.

Income tax hits wages, but leaves inherited or investment-based wealth largely untouched. A doctor earning £100,000 pays 40 percent income tax, while someone with millions in the bank pays almost nothing on that capital growth unless they sell assets and trigger capital-gains tax. A wealth tax would close this loophole by focusing on accumulated assets, delivering a more stable revenue source that grows with the fortunes of the richest. Detailed proposals by Tax Justice UK explain how a self-declaration system, backed by HMRC compliance and enhanced asset registries, could make this both feasible and fair.

Critics argue that asset valuation is complex and ripe for avoidance. However, we already have similar systems for inheritance and property taxes. By requiring annual self-assessment of net wealth and investing in HMRC’s capacity to audit and maintain registers of land, companies, and high-value assets we can ensure compliance. Those with more than £10 million can easily afford professional advice, while the public sector gains the resources it needs to do its job effectively.

The link between extreme wealth and environmental breakdown is undeniable. The richest 1 percent - about 77 million people globally earning over $140,000 (£114,000) a year - are responsible for more than twice the carbon pollution of the poorest half of humanity, according to The Guardian. In fact, the super-affluent used up their fair share of the 2025 carbon budget in just ten days. Meanwhile, the poorest communities, who contribute the least to global emissions, bear the brunt of floods, droughts, and heatwaves. Taxing substantial wealth would not only raise revenues for climate adaptation and renewable energy but also send a clear signal: those who consume the most must contribute the most toward a liveable planet.

Last month’s Sunday Times Rich List highlighted one of the starkest figures: just 350 families now control over £772.8 billion; about 26 percent of the UK’s total wealth, while 14 million people live in poverty today (Independent). The top fifty families alone own more than the poorest half of the population combined (over 34 million people). Their collective fortunes could fund the NHS three times over. This level of concentration means that, each year, substantial sums that could alleviate poverty, fund schools, or insulate homes instead sit idle in offshore accounts or fund yet another private jet.

What could £24 billion buy?

Reversing disability benefit cuts: Fully restoring planned reductions in disability payments

Reinstating winter fuel payments: Ensuring no pensioner shivers in their home

Investing in renewables: Building community-owned wind and solar projects that deliver clean power and local jobs

Strengthening public services: Alleviating NHS waiting lists, upgrading school facilities, and improving social care

Rewilding and nature restoration: Locking in carbon, boosting biodiversity, and creating green spaces accessible to everyone.

Remarkably, there’s a growing chorus of millionaires who agree this is fair. The Patriotic Millionaires are a non-partisan network of British millionaires calling for higher taxes on extreme wealth so ordinary people aren’t "left endlessly picking up the pieces of a broken economy." Their stance demonstrates that a properly designed wealth tax isn’t just a dream; it’s a policy some of those who would pay it are actively demanding.

We currently tax people's labour harder than capital. We have millions in poverty alongside fewer than 20,000 individuals with assets above £10 million. This isn’t a shortfall of wealth; it’s a failure of distribution. Labour has an opportunity and a responsibility to adopt a credible wealth-tax proposal ahead of the next election. By setting the rate at 2 percent for those above £10 million, they could raise £24 billion annually without touching the estates of ordinary homeowners or small-business owners. That’s radical, it’s practical, and it’s what the public wants.

Imagine a Britain where we tax wealth more than work. Where no one has to skip meals to afford heat, and where every child has access to a well-funded local school. A wealth tax is not just a fiscal tool, it’s a statement about our shared values. It says that those who’ve benefited the most from our society’s infrastructure and stability should invest back into it. It says we believe in systemic change: an economy that serves people and planet rather than private profit.

The case is clear, the data’s in, the models work, and support extends far beyond the usual activists’ circles. If we want to tackle poverty, strengthen public services, and confront climate breakdown, taxing extreme wealth must be part of the solution. Let’s give politicians no excuse to delay. Let’s build a tax system that genuinely works for the many, not the few.